student loan debt relief tax credit for tax year 2021

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. When setting up your online account do not enter a temporary email address such as a workplace or college.

Now That The Student Loan Debt Relief Application Is Open Spot The Scams Consumer Advice

For more about student loan debt relief learn whether your forgiveness will be taxed by your state and how debt forgiveness could impact your credit.

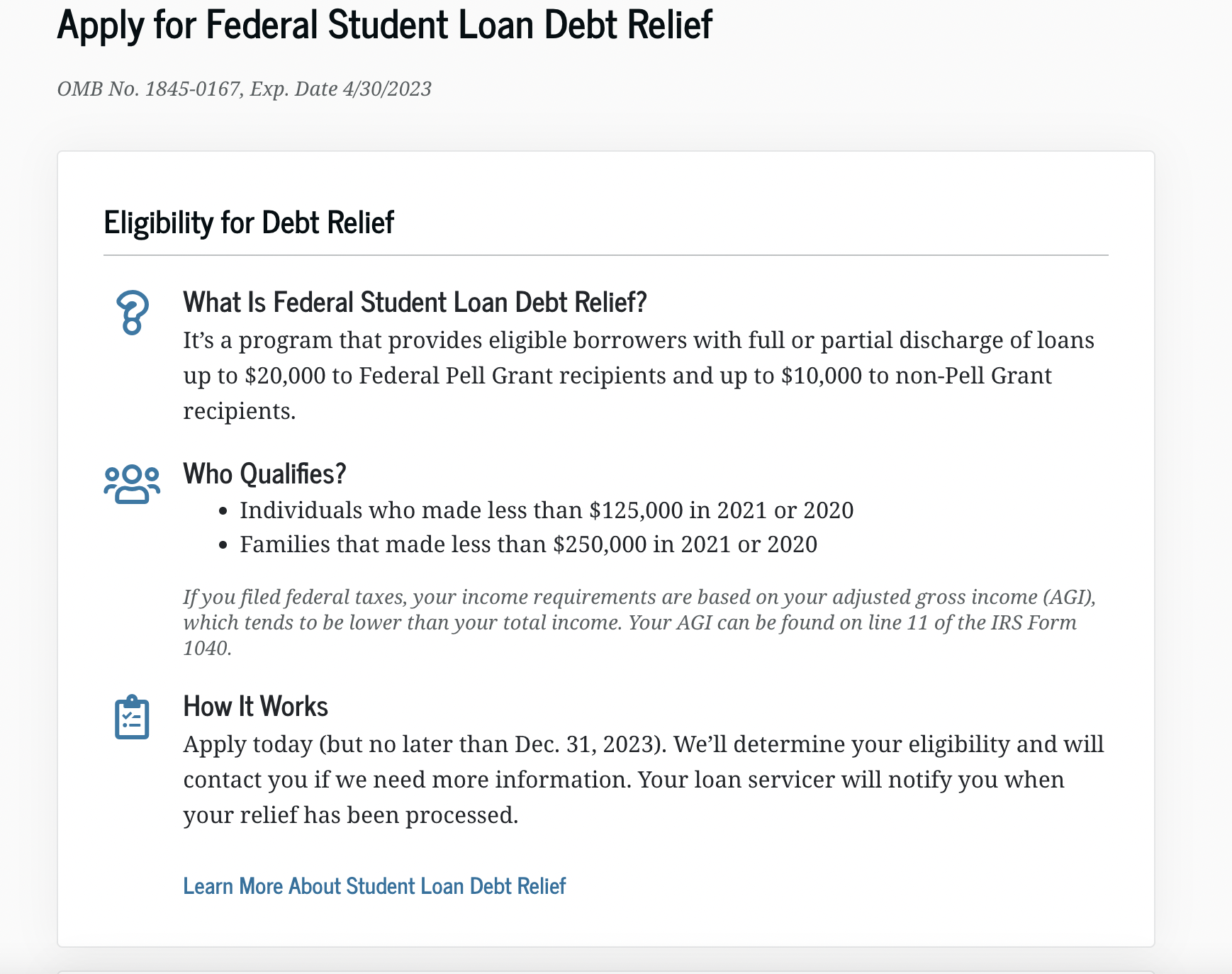

. If you earn less than 125000 a year youll get up to 10000 knocked off your student. Student Loan Debt Relief Tax Credit 6 North Liberty Street 10th floor Baltimore Maryland 21201. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents.

POTUS said the debt relief plan aims to give everybody a little more breathing room. CuraDebt is an organization that deals with debt relief in Hollywood Florida. A copy of your Maryland income tax return for the most recent prior tax year.

Were eligible for in-state tuition. The Student Loan Debt Relief Tax Credit is a program. For tax financial debt relief CuraDebt has an extremely professional group solving tax obligation financial debt concerns such as audit protection complicated resolutions uses in concession.

Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years. However the loan forgiveness element does not apply to private student loan borrowers who account for an estimated 8 of total outstanding student loan debt in the US.

When setting up your online account do not enter a temporary email address such as a workplace or. Federal Student Aid. The Student loan Debt relief Income tax Borrowing from the bank is a course authored under 10-740 of the Income tax-General Article of your Annotated Code of Maryland to provide a tax.

For Maryland Residents or Part-year Residents Tax Year 2021 Only. About the Company Student Loan Debt Relief Tax Credit For Tax Year 2021. The Maryland Higher Education Commissionmay request.

When setting up your online account do not enter a temporary email address such as a workplace or. Have the debt be in their the Taxpayers name. Maryland Higher Education Commission Attn.

Tax obligation financial debts could be a result of errors from a previous tax obligation preparer under withholding failing to send payroll tax withholdings to the internal revenue service. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application. Do NOT include entire TurboTax packet entire HR Block packet IRS form 1040 form W-2 form.

In 2020 or 2021 as a. Tom Wolf through a change in the state tax code made last year announced that the up to 20000 in student loan relief that Pennsylvanians are eligible to receive wont. Have at least 5000 in outstanding student loan debt upon.

Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan. Have incurred at least 20000 in undergraduate andor graduate student loan debt. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

This application and the related instructions are for Maryland residents. It was founded in 2000 and is a.

Student Loan Forgiveness Statistics 2022 Pslf Data

Student Loan Debt 2022 Facts Statistics Nitro

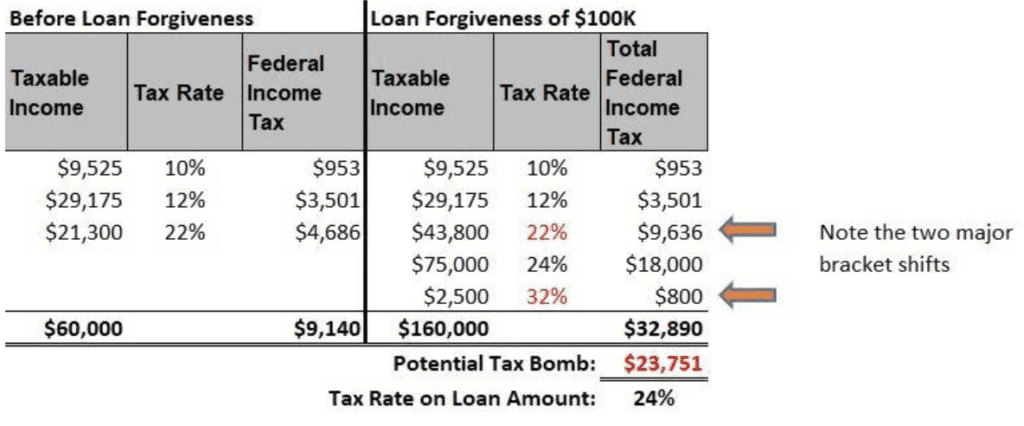

Will You Owe Taxes If Your Student Loan Is Forgiven Forbes Advisor Forbes Advisor

Which States Are Taxing Student Loan Forgiveness As Usa

Some States Could Tax Cancelled Student Loan Debt Kiplinger

Biden S Student Loan Forgiveness Application What To Know Theskimm

Is Student Loan Forgiveness Taxable It Depends

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

Price Tag Of Biden S Student Debt Relief Is About 400b Cbo Says Politico

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

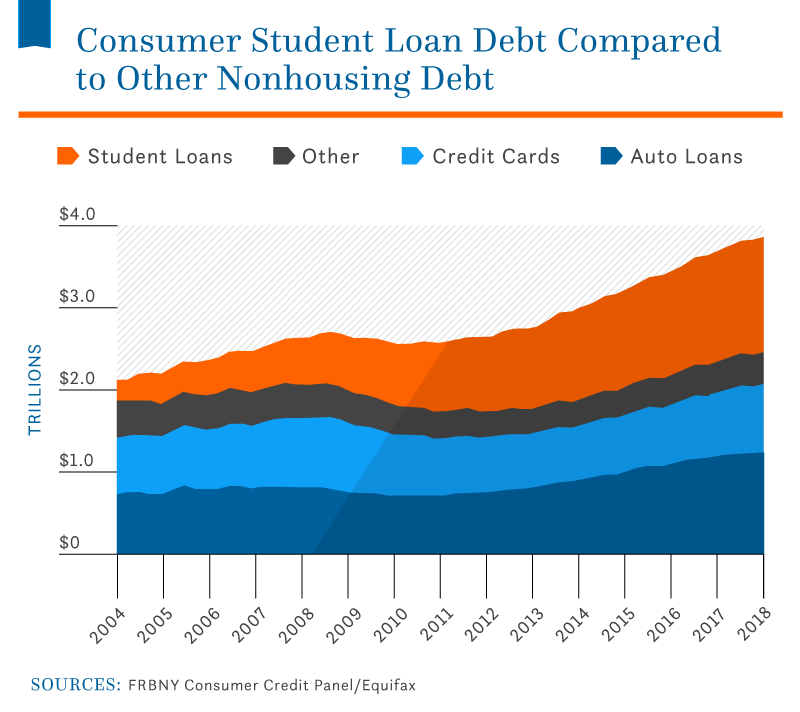

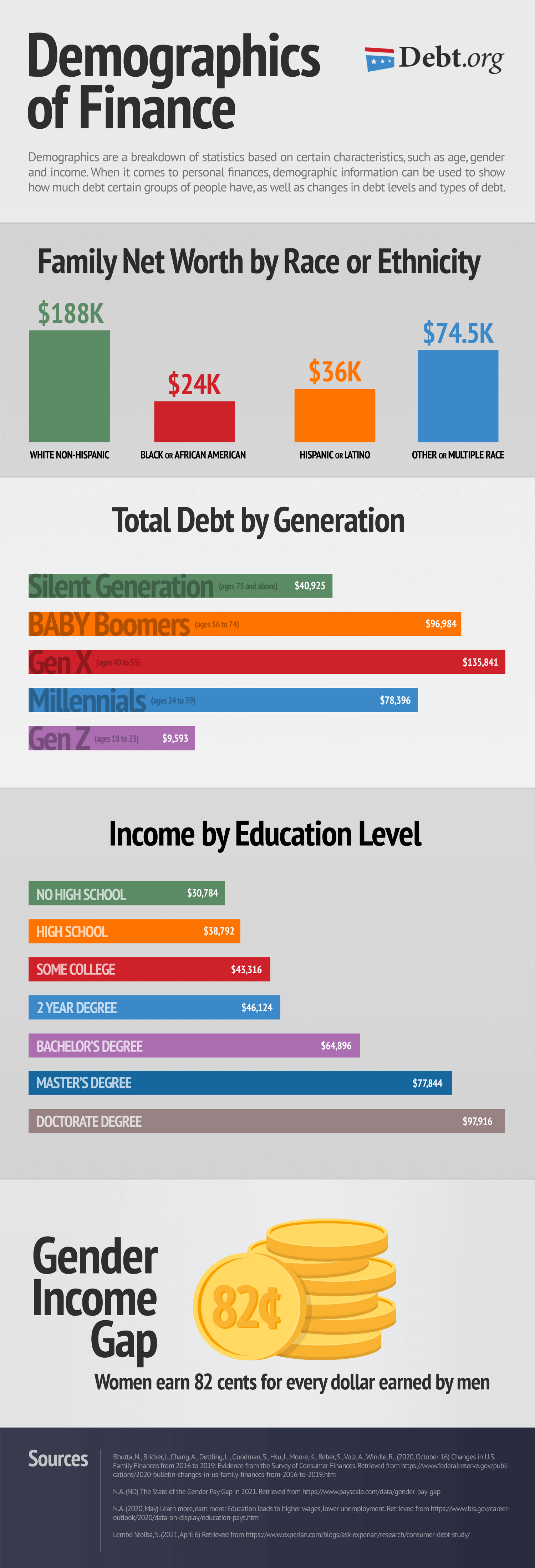

Consumer Debt Statistics Demographics In America

Biden S Stimulus Package Makes Student Loan Forgiveness Tax Free Bankrate

Californians May Have To Pay Taxes On Forgiven Student Loans Los Angeles Times

Biden S Student Loan Forgiveness Plan Your Questions Answered The New York Times

Student Loans In The United States Wikipedia

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

Military Student Loan Forgiveness And Discharge Programs Military Com

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

Taxes On Forgiven Student Loans What To Know Student Loan Hero